Step-by-step procedures for a simpler year-end closing

Forgestik’s clients have access a document from SAP and explains, step-by-step, the proper procedure to end the year. The instructions cover multiple subjects, such as how to run an account or the statement of operations.

Note that this document is also very useful, if you ever find yourself forgetting how to access the draft, for example. The document will help you find your way back easily. At the end, you’ll even find a checklist to make sure you don’t forget anything. Since the year-end procedure hasn’t changed in our recent versions, this document can be used for SAP 9.1 and the subsequent versions.

Forgestik also offers a document that summarizes how to close the current year in 6 easy steps in SAP Business One.

Do you need our experts' tips for your financial management in SAP Business One? Contact us now!

Step 1 – Accounting preparation

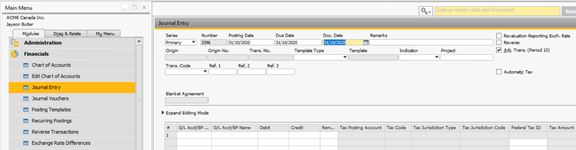

For the first step, we’ll need to consolidate the accounts. If we have to adjust entries in the accounts, we’ll obviously have to make a book entry. Please note that when we’re making a book entry, we can choose to check adjusting entry (13th period).

Also remember that it won't be a real accounting period in SAP. However, in the statements, you can specify that you want to ignore the adjustments. This way, you can compare a report with the adjustments and another without them.

Step 2 – Database backup

Creating a backup of your database is optional. However, by doing so, if anything were to happen to your database, you could always go back without losing your progress.

Step 3 – Preclosing accounting periods

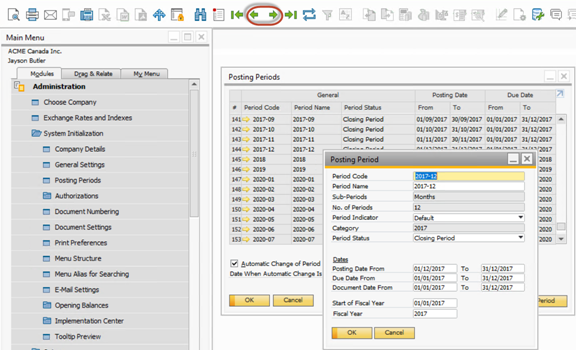

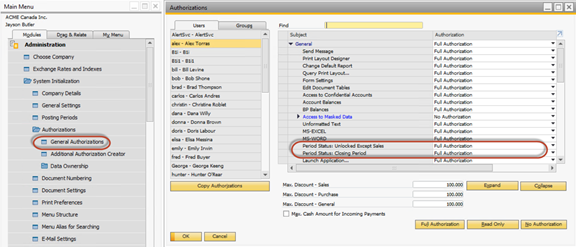

In SAP Business One, accounting periods have four different statuses. When the period is "Open,” anybody with the right to create an accounting record will be able to do so. When the period is "Closed,” no one will be able to create a transaction, not even a super user. "Open excluding sales" and "Preclosed" are direct references to authorizations.

When the time has come to close the year, make sure that nobody can work in the year that’s being closed. Changing the status of the accounting periods and indicating them as "Preclosed" is an additional safety measure. If the periods were "Closed,” it would be important to modify their statuses to "Preclosed.” Otherwise, we won't be able to proceed with the year-end procedure.

Here’s a tip on how to make your life easier without individually changing the status of each period: you can click on the first period, change its status, and use the arrows (see below) to quickly go from one period to another.

It is imperative that the first month of the new year is "Open.” For each revenue and expense accounts, SAP will create a transaction, dated December 31st, in order to put the account back to 0. Then, it will send that transaction to a buffer account and, on January 1st, will undo the buffer account to send it back in the retained earnings.

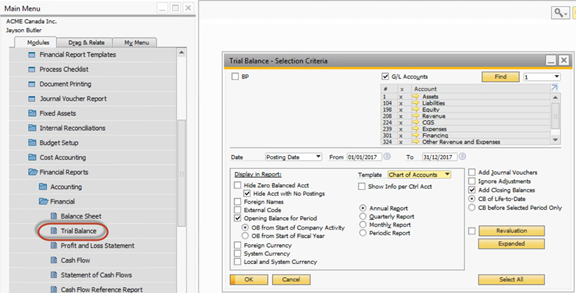

Step 4 – Verifying the balance

Now, we have to check the balance to make sure that there is no opening balance for revenues and expenses. If there was a remaining balance in the revenues and expenses, it would mean that some transactions from last year wouldn’t have been "closed.” If it were to happen, it is imperative to go back in order to close everything that hasn’t been closed yet. Only then can you go forward with the next step.

Keep in mind that you can close the same year twice, for example, if you went back and rectified a few things. So, that means that you always have the possibility to go back and reopen our periods for some additional entries. Once this verification has been made, we recommend verifying the income account so we can observe what kind of profits we can expect for the year to come.

Step 5 - Closing

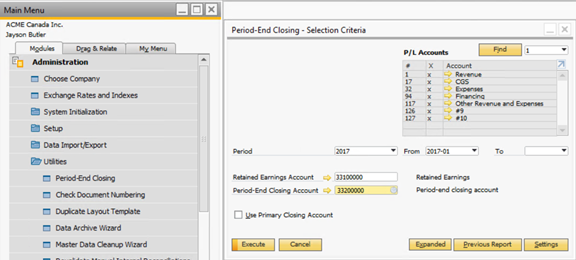

Here’s the path you can take to close the year: Administration – Utilities – Period-End Closing

First of all, make sure you’ve checked the boxes of every account. Then, you’ll have to choose the period and put down its start date and its end date. Ideally, periods will always last one year.

Then, record your retained earnings account and your buffer account (dated with the end date). The latter will collect all balances and will send them back to the former (dated with the start date of the new period). The next step is to click on "Execute" and validate the profit (as seen before in the income account).

Do not forget to put the date of the last day of the period we’re closing. In order to make sure that all the numbers work, select every account and simply click on "Execute.”

Step 6 – Closing all accounting periods

Here’s the path to access every accounting periods’ status:

Administration – General Authorization – Accounting Period

This step is pretty straightforward, all you need to do is change the statuses of the accounting periods that you wish to close to "Closed".

Get help from experts

There you have it! You’ll be able to use this simple and practical way to close the year for years to come. Your company will be able to analyze its data in a useful way, all while being able to observe opportunities for growth and improvement for the next 12 months.

Whether you have a small problem, for example if your SAP system has issues or isn’t working the way you wished it worked, just reach out to us! It’ll be our pleasure to do anything in order to resolve the problem you’ve encountered. Contact us!